- Lender Specialty

- 2nd liens - Closed ending and HELOCs

- Agency(FHA/VA/Conventional/USDA)

- Bank Statment Loans

- Bridge Financing

- Commercial

- Two Time Close Construction

- Bond/DPA Loan Programs

- DSCR

- Fix and Flip

- Jumbo Loans

- Non-QM

- One Time Close Construction

- Physician Loans

- Ground up construction (Non-QM)

- Renovation

- Reverse Mortgages

- SBA Loans

- Lender Specialty

- Artificial Intelligence

- Business Operations

- IT Security

- Marketing

- Mortgage Operations

- Appraisal

- Closing

- Compliance

- E-Close

- Income Calculation Tools/Self-Employment/Bank Statements

- Loan Origination System

- Point Of Sale

- Processing

- Renovation/construction management

- Servicing

- Smart fees

- TPO Tech

- Underwriting

- Verification

- Price & Shop

- Home Insurance Marketplace

- Home warranty marketplace

- MI pricing engine

- Product pricing engine

- Jobs

Price & Shop

Overview

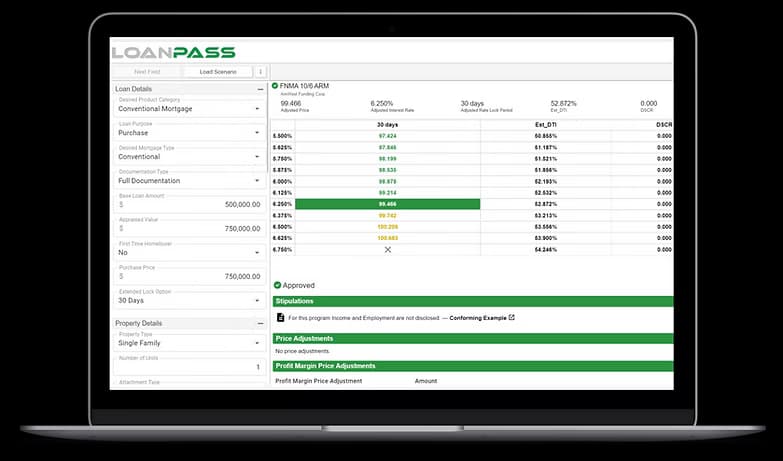

LoanPASS is a leader in product pricing and loan decisioning technology solutions, giving lenders unprecedented control over loan pricing and eligibility. Using a no-code approach, banks, credit unions, IMBs, private lenders, and investors can quickly configure any lending product—from non-QM and construction loans to reverse mortgages and DSCR loans. To learn more about LoanPASS and its open API integrations with leading LOS, POS, and CRM providers, visit https://www.loanpass.io/

Features

- Real-Time GSE Pricing

- Rules-Based Decisioning Engine

- Configurable rules handle pricing, eligibility, and underwriting across any asset class

- No-Code Configurability

- Lenders can instantly create new fields, rules, products, and pricing logic without vendor reliance

- Built for Scale & Performance

- Modern architecture (Rust, AWS Lambda, React)

- Unlimited User Access

- No seat licenses, no caps

- Open API Ecosystem

Integrations

- Encompass

- Meridian Link

- Vesta

- Elphi

- More..

LoanPASS

LoanPASS is a leader in product pricing and loan decisioning technology solutions, giving lenders unprecedented control over loan pricing and eligibility.

You are not logged in. to proceed.